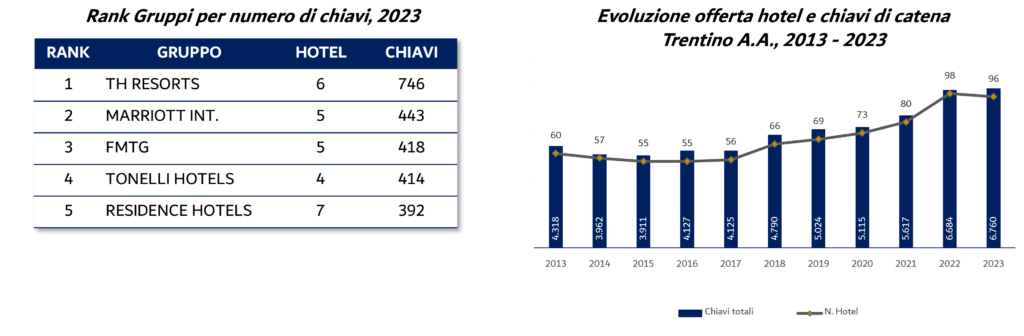

According to Thrends’ Chain Hotels Database, there are currently 96 chain hotels in Trentino-Alto Adige, with 37 located in the province of Bolzano and 59 in the province of Trento, totaling 6,760 keys. Branded hotels have experienced growth over the past 10 years, with chain hotels growing at a Compound Annual Growth Rate (CAGR) of +4.8% since 2013. The region currently hosts 39 groups, both international and domestic. Residence Hotels and Union Hotels Canazei lead with 7 properties each, followed by TH Resorts with 6, and Blu Hotels, Dolce Vita Hotels, Dolomiti Clubres Hotels & Resorts, FMTG, and Marriott International with 5 each.

In terms of key count, TH Resorts leads with a portfolio of 746 keys, followed by Marriott International with 443 keys, and FMTG in third place with 418 keys. The average size of chain hotels in Trentino-Alto Adige has remained relatively stable, with a slight decrease from an average of 72 rooms in 2013 to 70 rooms in 2023. Four-star hotels constitute the majority, representing 60% of the population, while branded 5-star hotels number 10, all located in the province of Bolzano.

There are four chain hotels in the pipeline for the region: the opening of Sport Hotel Astoria by Swadeshi Hotels, a 4-star property with 31 keys in Badia (BZ), and Hotel Annamaria, a 4-star property with 100 keys in Folgarida (TN) by Greenblu Hotels & Resorts, is expected by the end of 2023. Castel Badia by San Domenico Hotels, a 5-star property with an opening in San Lorenzo di Sebato (BZ), is anticipated for 2024. Motel One in Bolzano is expected to open in 2025.

Regarding business models, direct ownership is the predominant model for almost half of the hotels, accounting for 48%. Leasing is in second place with 39%, while franchising is chosen by 10% of the structures.

According to Thrends’ Luxury Hotels Database, Trentino Alto Adige ranks sixth in Italy for the number of 5-star hotels in 2023, with 58 structures (50 in the province of BZ and 8 in the province of TN). The luxury accommodations sector has grown at a CAGR of +10.8% from 2013 to 2022. In 2013, the presence of both domestic and international chain hotels in the region was relatively low, around 9%. However, subsequent openings increased this percentage to 21% in 2022, with 10 chain structures out of a total of 58. In 2023, this percentage is currently reduced to 17%.

The best-performing structures in 2022 were “Quellenhof Luxury Resort Passeier,” followed by “Andreus Golf & Spa Resort” and “Lefay Resort & SPA Dolomiti.” The opening of “Hotel Castel Badia” by SD Hotels is planned for 2024.

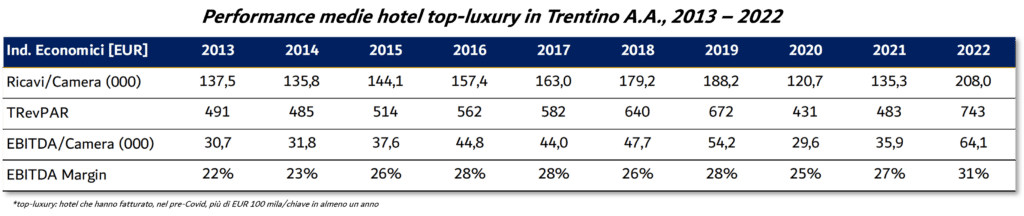

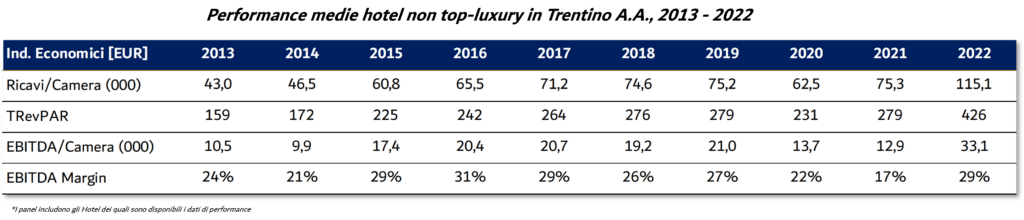

Analyzing the average performance of top-luxury and non-top-luxury hotels from 2013 to 2019 reveals a positive trend in key revenue and TRevPAR, averaging around a CAGR of +5.4%. In 2020, however, top-luxury hotels experienced a 36% decline in revenue, compared to a 17% decline in non-top-luxury hotels. In 2022, the turnover of the top-luxury tier increased by 11% compared to 2019, while the non-top-luxury tier increased by 53%. In terms of profitability, from 2013 to 2019, non-top-luxury hotels slightly outperformed, with an average EBITDA percentage of 27% compared to 26% for the top-luxury panel.

If you want to read more of these analysis visit The Bulletin or contact hernandez@thrends-italy.com