According to a recent study by Thrends, the global cruise industry is experiencing a sustained recovery after the two-year period marked by the COVID-19 pandemic. Considering the 2022 economic results of the three main operators in the sector: Carnival Corporation & plc (which includes Costa Cruises among others), Royal Caribbean Cruise Ltd, and Norwegian Cruise Line HLD; the volumes are not yet fully comparable to pre-pandemic levels, but ticket prices and some onboard service costs have led to a significant revenue recovery.

The Carnival group’s revenue increased from USD 1.9 billion in 2021 to USD 12.2 billion in 2022, with 58% attributed to direct ticket sales and 42% to the sales of other onboard services (beverages, excursions, shuttle services, personal expenses, laundry services, themed and à la carte restaurants, and casino expenses), which saw an increase compared to 2019 when these revenues represented 32%. This trend seems to be confirmed at Royal Caribbean, which raised the revenue generated from onboard sales from 28% (in 2018) to 35% (in 2022) of the total of USD 8.8 billion; Norwegian, instead, only increased by three percentage points (compared to 2019) reaching 33% of the total revenue of USD 4.8 billion.

In the first two quarters of 2023, some groups have exceeded expectations, with Carnival reaching its revenue record in Q2: USD 4.9 billion and an EBITDA of 681 million (13.8% of revenue volume). During the same period, Royal Caribbean resumed operations with its entire fleet and recorded an 82% Load Factor. Analysts expect a turnover of approximately USD 3.4 billion and an EBITDA of about 1 billion. The data for Norwegian’s Q2 is not yet available (scheduled for release on 01/08/2023), but based on Q1 results and analysts’ predictions, it should align with its competitors.

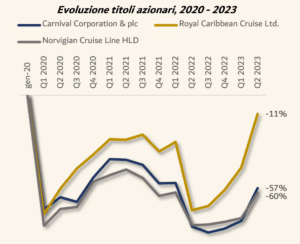

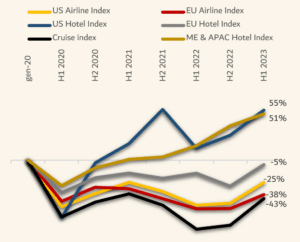

Analyzing the stock values of these three groups, they are still below pre-COVID levels. In a broader perspective, according to an analysis by THRENDS comparing the indices* of US airlines, EU airlines, EU, US, ME & APAC hotel companies, only American and Middle Eastern & Asian hotel companies have managed to recover and improve their pre-pandemic values. However, all others do not seem to have fully recovered. The cruise sector has been particularly impacted by the Russo-Ukrainian crisis, affecting fuel costs and slowing down the recovery.

According to Cemar Agency Network, the Italian market is also showing significant growth. Their predictions indicate that by the end of 2023, there will be approximately 18.8 million passengers moving through Italian ports (+9.2% compared to 2019). The number of ship calls will be slightly lower than in 2022 (4,915 compared to 4,955 in 2022), with 168 ships in transit representing 52 shipping companies. There will be 72 ports involved in cruise traffic, with the highest traffic expected in Civitavecchia (forecasting 2.8 million passengers), followed by Naples and Genoa (1.4 million each). The most active companies in the Italian territory will be MSC (approximately 4 million passengers), Costa Cruises (part of the Carnival group with 2.4 million), Royal Caribbean (1.2 million), Norwegian Cruise Line (1.1 million), and Celebrity Cruises (part of the Royal Caribbean Group with 0.8 million).

According to Cemar Agency Network’s estimates, the growth will continue in 2024, with an expected total of 13 million passengers moving through Italian ports.